The consolidation of the conveyancing market continues as the top 200 conveyancing firms now control more of the market (39%) than ever before, according to the Q1 2019 edition of the Conveyancing Market Tracker from Search Acumen, the property data insight and technology provider.

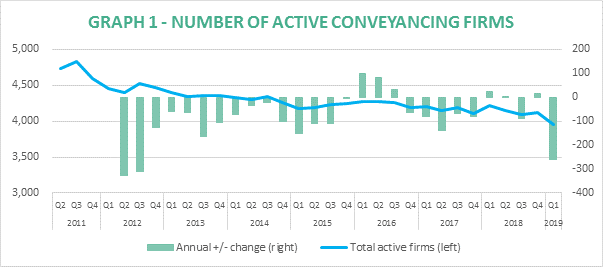

The tracker – which monitors business performance and competitive pressures in the conveyancing market – shows that the increasing consolidation of the market has resulted in a further drop in the number of active conveyancing firms in England and Wales. The total dipped below 4,000 (3,961) for the first time between January and March this year, down 9% on five years ago – equivalent to 369 fewer active firms.

Top 200 take record market share

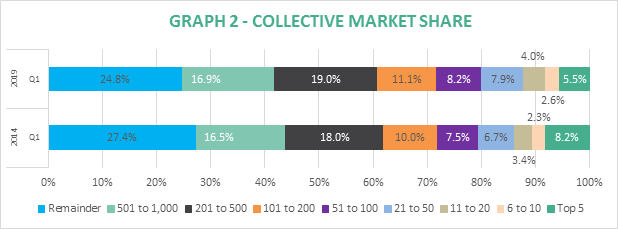

The latest data for Q1 2019 shows that the top 200 conveyancing firms now control more of the market (39.3%) than ever before. While this is a modest increase of 0.1% on Q4 2018 (39.2%), it represents a significant long-term gain from 31.9% share which the top 200 firms held back in Q2 2011.

While there has been consolidation at the top end of the market and the volume of transactions has increased, the top five conveyancers’ overall slice of the pie has decreased collectively from 8.2% five years ago to 5.5% now. Those firms ranked 11th to 200th now account for nearly a third (31.2%) of the market, up from 27.6% in Q1 2014.

Bigger firms take more business as market consolidation continues

The consolidation of activity at the upper end of the market has become a dominant theme over recent years. The top 1,000 conveyancers – a quarter of active conveyancing firms – now deliver more than three-quarters of transactions for the first time on record (75.2%). In contrast, the remaining 2,961 who were active in Q1 are competing for fewer than a quarter (24.8%) of transactions overall.

Low-volume firms or ‘occasional conveyancers’ have continued to be hit hardest as the number of firms processing between one and five transactions a month was down almost 9% quarterly and 14% compared with five years ago, marking a fallout of over 230 of the smallest conveyancing firms.

Further, the number of firms processing fewer than 50 transactions a month is down 10% on five years ago to another all-time low.

Market slowdown felt across the sector

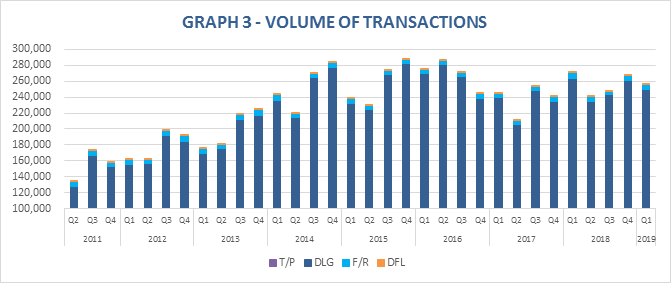

Total conveyancing transaction volumes were down 4% on a quarterly basis, as the market processed 255,989 cases in Q1 2019 compared to 267,438 in Q4 2018, and down 6% annually. The market has made only modest gains in the last 24 months, with volumes up 4% on Q1 2017. Total activity among firms outside the top 1,000 conveyancers dropped 8% annually.

Despite this slowdown in overall activity, the tracker shows that average number of cases conveyancing firms dealt with in Q1 2019 (65) remains healthy even in the face of market headwinds – up 11% on five years ago as fewer active firms are left competing for business.

Andy Sommerville, Director of Search Acumen, comments:

“The consolidation of the market continues in conveyancing. However, while larger firms are processing a higher share of activity, it would be a mistake for them to rest on their laurels.

“The beginning of 2019 has marked a dampening of overall current activity. During the lull in transactions, we encourage those companies who have strengthened over the last few years to pause and take stock of the current landscape to avoid missing out on key opportunities resulting from the current industry shifts.

“As smaller firms that tend to operate on a more local scale are increasingly squeezed out of the market, we risk seeing a consequent fallout of their specialist knowledge. It is here that technology can play a crucial role. Continued efforts by the Government to digitise property and land data – coupled with innovative and efficient ways to add to and maximize the growing pool of information – mean that conveyancers and lawyers can benefit from better insights at their fingertips.

“Our analysis shows that average number of cases conveyancing firms dealt with in Q1 2019 still remains relatively healthy even in the face of market headwinds. However, going forward we expect a prevailing sense of uncertainty until the ongoing political fog lifts across the UK. There may be challenging times ahead if firms want to grow beyond their current level of business, and it will be even more critical that companies take the reins and prepare now if they are to weather any future storms.”